Building momentum: Harnessing factor investing in Australian equities

5 minutes reading time

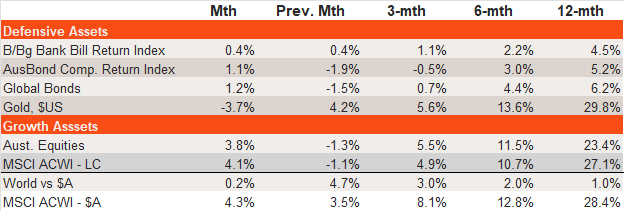

Asset class performance

- November was generally a risk-on period with growth assets outperforming defensive assets, and solid gains in both global and Australian equities.

- Another supportive Fed rate cut and the re-election of Donald Trump as US President bolstered equity markets, especially US stocks.

- Fixed-rate bonds benefited from a modest decline in bond yields, though gold corrected – likely reflecting a firmer $US.

- Over the past year, equities and fixed-rate bonds have enjoyed positive returns, though the former have handily beaten the latter – reflecting stronger valuation gains and solid growth in corporate earnings.

- In defensive assets, bonds have beaten cash though gold remains the best-performing defensive asset over the past year. In growth assets, global equities have modestly beaten Australian equities.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

Defensive assets

- As noted above, bond yields eased over November, helping fixed-rate bond returns.

- US 10-year bond yields fell 0.12% to 4.17%, while Australian 10-year bond yields fell 0.16% to 4.34%. Credit spreads remained tight.

- The market expects 0.75% of Fed rate cuts over the coming year, while the RBA is expected to cut rates by 0.5%.

- Despite easing bond yields, gold fell back 3.7% in November – which likely reflected a firmer $US due to expected Trump fiscal stimulus.

- Prospective central bank rate cuts as inflation eases continue to bode well for lower bonds yields and fixed-income returns beating cash.

Source: Bloomberg, Betashares. Past performance is not indicative of future performance. Predicted values based on the Betashares bond yield models, which in turn reflect current policy rates and 12-month forward market expectations.

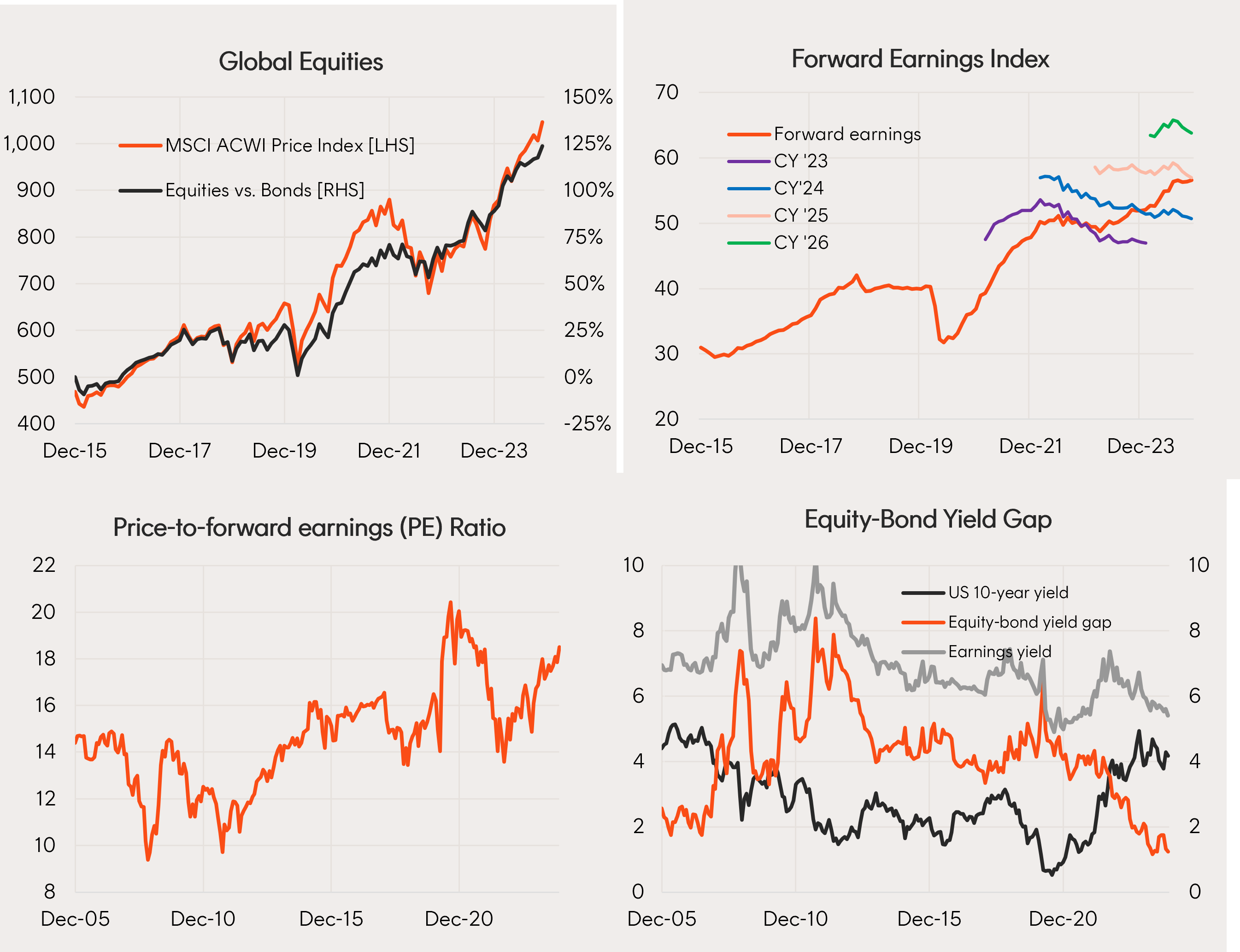

Growth assets

- Easing bond yields helped push up the global equity price-to-forward earnings (PE) ratio by 3.7% in November to 18.5. With forward earnings inching up 0.3%, the MSCI All-World Index returned 4.1% in local currency terms, and 4.3% in unhedged $A terms.

- With the global PE valuation relatively elevated at 18.5, lower bond yields should help support valuations. Earnings growth expectations also continue to suggest solid growth in forward earnings over the coming year. That said, recent earnings downgrades – which have led to flatter forward earnings growth in recent months – bear watching.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

Among select global equity ETFs, the Nasdaq (ASX: HNDQ), banks (ASX: BNKS) and gold miners (ASX: MNRS) retain the best relative performance trends.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the MSCI All-Country World Index (local currency terms) for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

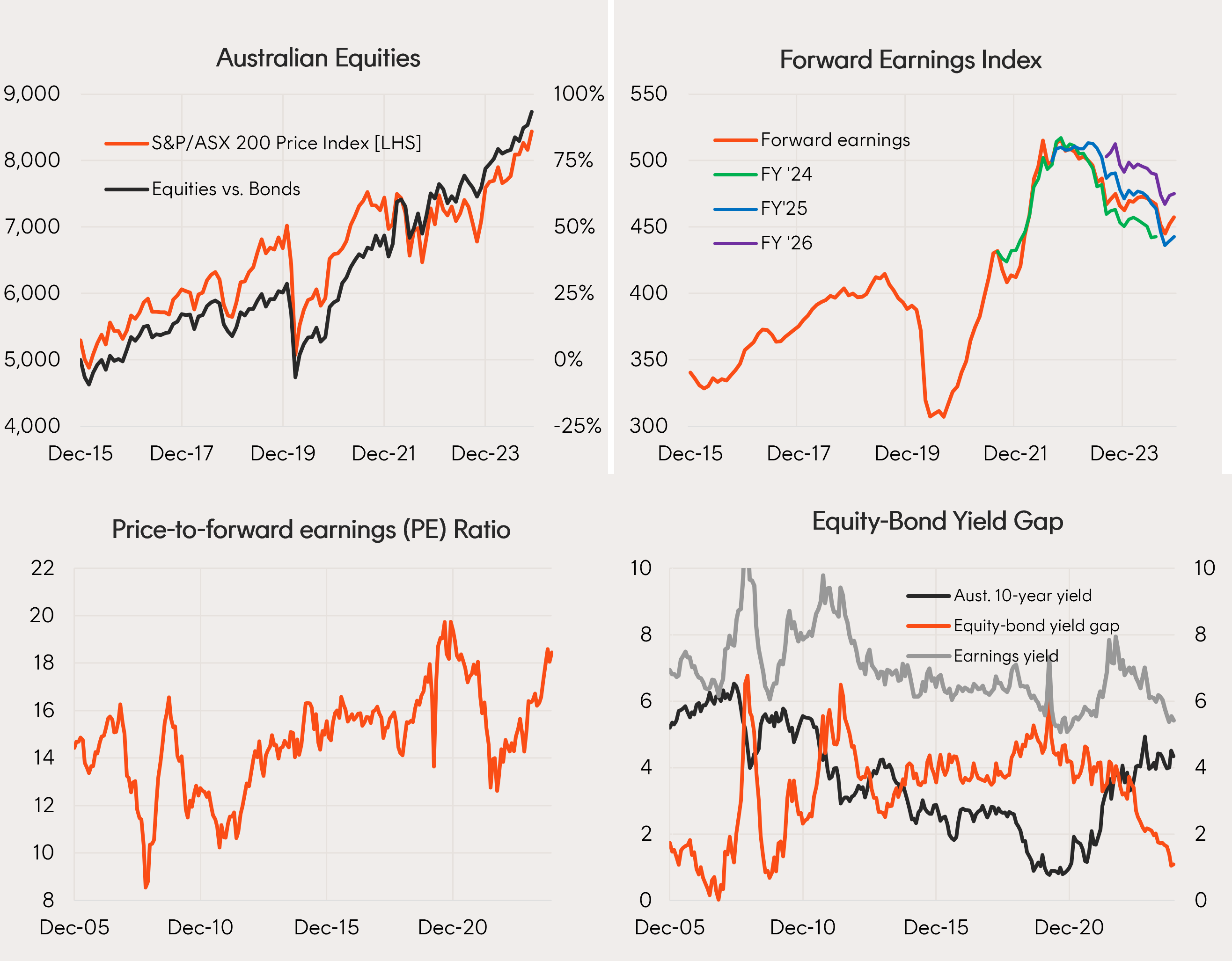

- Australian equities also benefited from lower bond yields and a 2.3% lift in PE valuations in November to 18.5. Forward earnings also rose 1.1%. Allowing for dividends, the S&P/ASX 200 returned 3.8%.

- As is the case globally, relatively high valuations leave the local market vulnerable without a decent decline in bond yields. Expected growth in forward earnings is also about half the 10-12% expected globally, with local earnings downgrades evident over the past year. That said, a recent bounce in earnings expectations is a hopeful sign.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Among select Australian equity ETFs, technology (ASX: ATEC), financials (ASX: QFN) and quality (ASX: AQLT) retain the best relative performance trends.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the S&P/ASX 200 Index for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant Product Disclosure Statement and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice.